》Check SMM aluminum product quotes, data, and market analysis

》Subscribe to view historical prices of SMM metal spot cargo

SMM News on July 13, 2025:

In June, the operating rate of China's primary aluminum alloy industry was 50.9%. After excluding the impact of inconsistent operating days from May, it fell by 1.2% MoM, with the off-season atmosphere intensifying. The PMI for primary aluminum alloy in June was recorded at 36.5%, a significant drop of 5 percentage points MoM from May, remaining below the 50 mark with a deepening contraction, indicating a notable increase in downward pressure on the industry. The core contradiction lies in weak domestic demand and cost suppression: both the production index (22.9%) and the new orders index (22.9%) hit new lows for the year, reflecting a contraction in domestic demand during the off-season coupled with aluminum prices fluctuating at highs, severely suppressing terminal cargo pick-up willingness and new orders. Meanwhile, the high product inventory index (58.8%) contrasts with the low procurement volume index (26.5%), highlighting enterprises' passive inventory buildup, cautious procurement, and the transmission of financial pressure. In terms of exports, the new export orders index (50.0%) remained flat with the 50 mark, but structural support relying on alternative channels such as Mexico could not offset the decline in orders to the US and the expected weakening of overall external demand in the future. Operating rates showed a "stable start followed by a decline" within the month, with orders remaining stable in the first ten days. However, the sustained high aluminum prices and seasonal factors in the middle and late ten days led to a slowdown in cargo pick-up, with some enterprises marginally reducing operating rates due to inventory and financial pressures, and most sample enterprises having planned production cuts for July.

However, entering July, it seemed that "plans could not keep up with changes." Despite July being a traditional off-season for aluminum processing, due to the even more sluggish performance of the aluminum billet market compared to primary aluminum alloy, the scale of production cuts by aluminum billet producers was intensifying. Nevertheless, under the requirement of liquid aluminum alloying, due to the more stable domestic demand for primary aluminum alloy, the surplus liquid aluminum was mostly redirected to the production of primary aluminum alloy. SMM predicts that the operating rate of domestic primary aluminum alloy in July is expected to rebound against the trend, but the rebound amplitude may be partially limited by the high-temperature holidays of enterprises in the next two months.

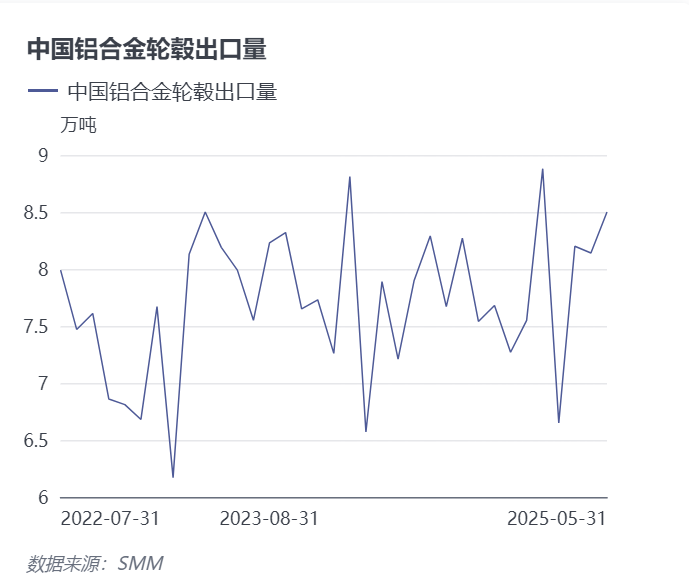

In terms of export data, customs data show that China exported 85,000 mt of aluminum alloy wheel hubs in May 2025, a continued increase of 4.4% MoM from April, with overall resilience standing out, and an increase of 7.6% YoY. Since the tariff war storm kicked off by the US in early April, the aluminum wheel industry, which has accounted for over 30% of direct exports to the US in recent years, should have been "the first to bear the brunt," and the market's export expectations for the aluminum wheel industry were relatively pessimistic. However, the aluminum wheel export data in April appeared "calm," and even more so after the release of May's data, exceeding the expectations of most people in the market.

SMM aluminum market research shows the following changes in the export destinations of Chinese aluminum wheel hubs in May, which deserve market attention:

1. Affected by the tariff hike, direct exports of aluminum wheel hubs to the US dropped by 900 mt to 22,300 mt in May, down 3.9% MoM and 2.6% YoY. Meanwhile, the share of exports to the US, which had fallen below the 30% threshold in April for the first time in years, further declined to 26% in May.

2. Exports to Mexico, which exceeded 10,000 mt for the first time this year in April, increased slightly by 800 mt in May, up 16% YoY, with the share rising to 14%, showing significant transshipment trade characteristics.

3. Exports to Morocco entered the top 10 for two consecutive months, a trend worth monitoring. SMM speculates this may be related to some domestic aluminum wheel hub manufacturers having overseas plants in Morocco.

From SMM's analytical perspective, after the US imposed additional tariffs in April 2025, China's aluminum alloy wheel hub exports demonstrated strong resilience, with the negative impact being smaller than expected. The export rush phenomenon under traditional trade friction warrants attention. Customs data shows overall stable exports in May, mainly due to the rigid supply chain advantage formed by China's concentration of 70% global capacity, coupled with top-tier enterprises' early deployment of overseas capacity in Mexico, Thailand, and Morocco. This strategy not only meets new overseas orders but also reduces reliance on direct exports to the US (current share has significantly declined). The industry's structural adjustment has shown initial results, but continuous monitoring of overseas capacity ramp-up progress and end-user market premium transmission capability remains necessary.

Looking ahead, although primary aluminum alloy operating rates may recover in July, the overall weak stability of the primary aluminum alloy and aluminum wheel hub industries in H2 2025 will likely persist under the triple pressures of sluggish off-season demand, unresolved Sino-US tariffs, and high aluminum price negative feedback. Aluminum wheel hub exports may enter a deep adjustment period, with substantial recovery awaiting clearer trade policies and effective cost pressure relief.